Water damage is a significant threat to homes, not just because of its immediate impact but also due to the long-term effects and substantial repair costs. In this article, we delve deep into the numbers that illustrate the true cost of water damage to homeowners.

| Topic | Key Points |

|---|---|

| Repair Costs | Costs can range from $2,000 for sink damage to over $72,000 for significant flooding. |

| Age of House and Water Damage | Older homes are at a higher risk, with those over 30 years being three times more susceptible. |

| Warning Signs | Increased utility bills, odors, stains, mold, and peeling paint are indicators of damage. |

| Prevention Tips | Monitor bills, maintain gutters, repair leaks, know your water valve, and shut off water when away. |

| Insurance Coverage | Understand your policy, considering backup coverage and personal property protection. |

Straight for the Wallet: Average Repair Costs

When water damage strikes, the costs can quickly add up. Here are some average figures for repair costs:

When water damage strikes, the costs can quickly add up. Here are some average figures for repair costs:

- Burst Pipes: Expect to shell out an average of $3,500 for damages caused by burst pipes.

- Sink-Related Water Damage: Repairs for sink-related issues can cost around $2,000.

- Malfunctioning Toilets: The damage can range widely, with costs between $2,000 to $10,000.

- Basement Flooding: For a 1,000 square foot basement, you may spend between $4,000 to $7,500.

- Leaking Washing Machines: The average cost here can exceed $6,000.

The overall average water damage and freezing claim is a staggering $10,849, with the cost of 12″ of water damage in a 2,500-square-foot house reaching $72,162.

Older Houses, More Problems

The age of your home significantly influences the likelihood of water damage:

- Homes more than 20 years old are 37% more likely to have water damage involving a shower.

- Once a house crosses the 30-year mark, it’s three times more likely to have a plumbing supply or drainage problem.

- It’s worth noting that 75% of water heaters fail before they are 12 years old, leading to potential water damage.

Signs You May Have a Potential Problem

Awareness is key in preventing extensive water damage. Keep an eye out for these warning signs:

- Sudden Increase in Utility Bills: This could indicate a leak you’re not aware of.

- Damp or Must Odors: These smells could signal hidden mold or mildew.

- Stains on Walls and Ceilings: These are often tell-tale signs of ongoing water damage.

- Signs of Mold or Mildew Growth: Visible mold growth is an obvious red flag.

- Peeling or Bubbling Paint: This can indicate moisture in the walls.

Tips to Prevent Water Damage

Prevention is always better (and cheaper) than cure. Here are some proactive steps to take:

- Monitor Utility Bills: An unexplained increase can signal leaks.

- Keep Gutters Clean: Ensuring proper drainage away from your home is crucial.

- Repair Leaks: Regular checks on faucets and gaskets can prevent major issues.

- Know Where the Main Water Valve Is: In case of an emergency, turning off the water supply can save you from extensive damage.

- Shut Off the Water Before Traveling: If no one is home, no one can address leaks before they cause damage.

Coverage That Can Help Protect You

Understanding your insurance coverage can give you peace of mind. Here’s what can help:

- Homeowner’s Insurance: Typically covers sudden and accidental water damage.

- Water Backup Coverage: Can protect you against sewer or drain backups.

- Service Line Coverage: Helps with the costs to repair or replace damaged service lines.

- Scheduled Personal Property: Provides broader protection for your valuables.

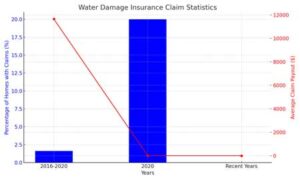

Remember, water damage is the second-highest homeowner’s insurance claim, so it’s important to know what your policy covers. One in fifty insured homes has a water-related property damage claim each year, so it’s not as rare as you might think.

By being aware of the causes, signs, and preventative measures, you can protect your home and your wallet from the ravages of water damage. Stay vigilant and prepared, and you’ll stand the best chance against this common household menace.

Final Thoughts

If you’re worried about water damage or just want to be prepared, don’t hesitate to reach out. RCS has a team of experts available 24/7 to answer your questions and provide you with the assistance you need. With a legacy of service in Sonoma and Marin Counties since 1975, RCS is your trusted partner in protecting your home against the unpredictability of water damage. Don’t wait for the signs to worsen—proactive steps today can save you from costly repairs tomorrow.