Water damage in residential areas is an increasingly prevalent issue, often leading to significant financial and emotional distress for homeowners. This article delves into the statistics, causes, and preventive measures related to residential water damage, providing valuable insights for homeowners seeking to safeguard their properties.

Table of Content

| Topic | Key Points |

|---|---|

| Introduction | Overview of the water damage issue and its impact |

| Causes and Statistics of Water Damage | Detailed statistics and primary causes of water damage |

| Impact and Restoration Costs | Financial impact and costs associated with water restoration |

| Prevention and Insurance Coverage | Preventive measures and insurance aspects |

| Conclusion | Recap and key takeaways |

| Call to Action | Encouragement to seek professional assistance |

With these insights, homeowners can better understand the risks and steps needed to prevent or address water damage effectively.

Causes and Statistics of Water Damage

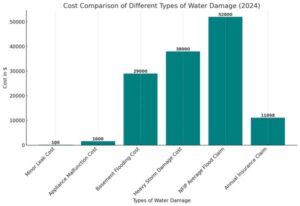

Water damage in homes can stem from various sources, ranging from natural disasters to household mishaps. Approximately one in 50 U.S. homeowners files a water damage claim annually. The average insurance claim for water damage is around $11,098, underscoring the severity of these incidents. In addition, 98% of basements will experience some form of water damage during their lifespan, further highlighting the pervasiveness of this issue.

The Financial Burden

The financial implications are considerable, with household water damage costs reaching up to $20 billion annually. Restoration costs vary depending on the affected area, such as plumbing repairs ranging from $1,000 to $4,000 and basement restoration costing between $500 and $80,000.

Did You Know – On any given day, home water damage emergencies effect 14,000 people.

Floods: A Major Contributor

Flooding, especially from natural disasters, is a significant contributor to water damage. The average flood claim payout from the National Flood Insurance Program is $52,000, far exceeding the average $4,200 relief provided by FEMA for disaster-affected homeowners.

In the next section, we’ll explore the impact of water damage on property and the costs associated with its restoration.

Impact and Restoration Costs

Water damage not only affects the structural integrity of homes but also incurs heavy financial costs for repair and restoration. The extent of the damage and the specific areas affected play a crucial role in determining these costs.

Varied Restoration Costs

Varied Restoration Costs

Restoration expenses can be substantial, with costs varying greatly depending on the extent and location of the damage. Simple repairs like fixing a leaky faucet can be relatively inexpensive, but extensive damages such as a flooded basement can be financially draining.

Health Risks and Property Value

Beyond financial costs, water damage poses health risks due to mold and mildew growth. This can significantly impact the well-being of residents and reduce the property’s overall value.

The next part of our discussion will focus on preventive measures and the role of insurance in mitigating the effects of water damage.

Prevention and Insurance Coverage

Taking preventive steps is crucial in avoiding water damage. Homeowners are encouraged to conduct regular maintenance and consider installing water shut-off systems to reduce risks. However, it’s essential to understand the limitations of home insurance policies in covering water damage.

Insurance Coverage Limitations

Standard residntial insurance policies typically cover sudden and accidental water damage but exclude events like floods or hurricanes. Homeowners need to be aware of these limitations and consider additional coverage if necessary.

Proactive Measures

Proactive measures such as inspecting water hoses in appliances and maintaining proper caulking in bathrooms can significantly reduce the likelihood of water damage. Implementing smart home technology for leak detection can also be a valuable investment.

As we conclude, let’s recap the key points discussed and understand how professional services can aid in managing water damage risks.

Conclusion

Residential water damage, a prevalent and costly issue, can be mitigated through proactive measures and a thorough understanding of insurance coverage. Homeowners must remain vigilant, regularly inspect their properties, and consider investing in preventive technologies. With the right approach, the financial and emotional burden of water damage can be significantly reduced.

Final Thoughts

If you’re facing water damage challenges or want to learn more about prevention, RCS is here to help. Our certified professionals have been serving Sonoma and Marin Counties since 1975, offering state-of-the-art solutions for water damage, mold remediation, and more. Visit our services page for detailed information or contact our 24/7 live operators at RCS Contact for immediate assistance.